top of page

Search

tax comply

Jul 270 min read

Whether an employee can claim credit for TDS even if the employer has not deposited it with the government ?

This common dilemma, where Tax Deducted at Source (TDS) appears in Form 16 and salary payslips but not in Form 26AS or the Annual...

tax comply

Jul 169 min read

Expatriate Taxation - Book

Kindly click below to download E- book

tax comply

Jul 101 min read

Certificate Requirement Under Circular No. 212/6/2024-GST for ITC Reversal on Post-Supply Discounts

The Central Board of Indirect Taxes and Customs (CBIC) has issued Circular No. 212/6/2024-GST dated 26th June 2024, providing much-needed...

tax comply

Jun 13 min read

New Rules for claiming deductions (under old regime) while filing Income Tax Return

#IncomeTax #ITR2025 #TaxFiling #ITRDeductions #OldRegime #Section80C #Section80D #Section80E #Section80EE #Section80EEA #Section80EEB...

tax comply

May 311 min read

Restoration of RoDTEP for AAs, SEZs & EOUs: A Boost for Indian Exporters

On 26 May 2025, the Directorate General of Foreign Trade (DGFT) issued Notification No. 11/2025-26, announcing a significant development...

tax comply

May 272 min read

Understanding Foreign Direct Investment (FDI) in India

Foreign Direct Investment (FDI) plays a crucial role in India's economic development. It brings in much-needed capital, technology, and...

tax comply

May 253 min read

Foreign Direct Investment in Indian Startup Companies

Foreign Direct Investment (FDI) plays a pivotal role in fueling the growth of India’s startup ecosystem. In recent years, the Government...

tax comply

May 254 min read

Purchase and Sale of Equity Instruments in India by Foreign Residents

India continues to be a hotspot for global investment, with foreign participation playing a pivotal role in the growth and...

tax comply

May 254 min read

Understanding Foreign Portfolio Investment (FPI) and How It Differs from Foreign Direct Investment (FDI)

India’s position as a global investment destination continues to strengthen, driven by sustained economic growth, regulatory reforms, and...

tax comply

May 254 min read

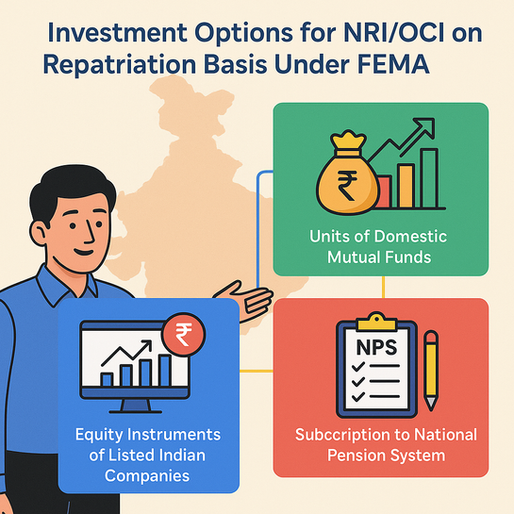

Investment Options for NRI/OCI on Repatriation Basis Under FEMA

As India continues to strengthen its position as a global investment destination, the Indian government and the Reserve Bank of India...

tax comply

May 254 min read

Unlocking India's Capital Markets: Investment Opportunities for Foreign Portfolio Investors (FPIs)

India’s fast-growing economy and maturing financial markets have created a fertile ground for foreign capital. For global investors...

tax comply

May 253 min read

Dispute Resolution Committee (DRC)

The e-Dispute Resolution Scheme 2022 was introduced to facilitate the disposal of dispute resolution applications filed by assessees....

tax comply

May 255 min read

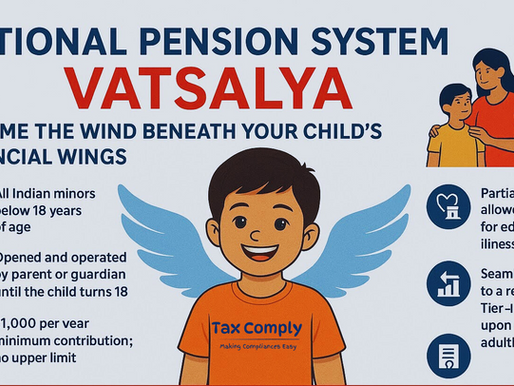

National Pension System Vatsalya (NPSV)

NPS Vatsalya is an innovative pension scheme under the National Pension System (NPS), designed specifically for minors. Its primary aim is to foster a pensioned society by encouraging early savings for retirement. Managed and regulated by the Pension Fund Regulatory and Development Authority (PFRDA), the scheme allows parents or guardians to open and operate an account for a minor, which seamlessly transitions into a regular NPS Tier-I account once the child turns 18.

tax comply

May 223 min read

M/s Yasho Industries Ltd. vs Union of India : Supreme Court Upholds Use of Input Tax Credit for GST Appeal Pre-Deposits

In a significant relief for taxpayers across the country, the Supreme Court of India has upheld the Gujarat High Court’s landmark judgment in the case of M/s Yasho Industries Ltd. vs Union of India (dated 17 October 2024), allowing businesses to utilize the Input Tax Credit (ITC) from their Electronic Credit Ledger (ECL) to make the mandatory 10% pre-deposit while filing appeals under the Goods and Services Tax (GST) law.

tax comply

May 202 min read

US Proposes 5% Remittance Tax on Non-Citizens: What Indian NRIs Need to Know

Introduction: A New Tax Proposal That’s Raising Global Alarm In May 2025, the US House Budget Committee cleared the “One Big Beautiful...

tax comply

May 194 min read

Taxation of Share-Based Long-Term Incentive Plans (LTIPs) in India

In the competitive global business environment, share-based compensation has emerged as a powerful tool to retain and motivate employees....

tax comply

May 184 min read

GST on Restaurant Services

The introduction of the Goods and Services Tax (GST) in India in 2017 marked a significant shift in the country’s indirect tax framework....

tax comply

May 174 min read

GST Appellate Tribunal (GSTAT) Procedures

The GST Appellate Tribunal (GSTAT) serves as the quasi-judicial body under the Goods and Services Tax law, responsible for resolving...

tax comply

May 165 min read

ITAT Ruling: No Need to Re-file Form 10-IE Every Year!

🧑⚖️ Case Summary & Legal Issue Facts: Section 115BAC allows individuals and HUFs to pay tax at concessional rates without availing...

tax comply

May 162 min read

bottom of page