top of page

Search

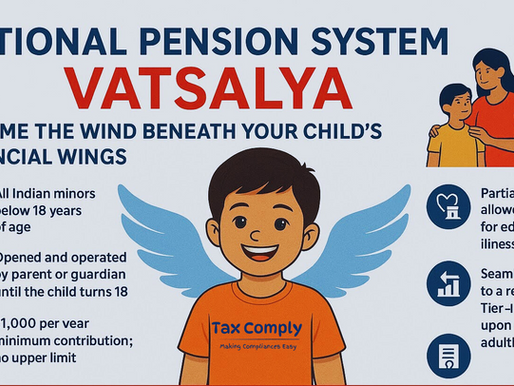

National Pension System Vatsalya (NPSV)

NPS Vatsalya is an innovative pension scheme under the National Pension System (NPS), designed specifically for minors. Its primary aim is to foster a pensioned society by encouraging early savings for retirement. Managed and regulated by the Pension Fund Regulatory and Development Authority (PFRDA), the scheme allows parents or guardians to open and operate an account for a minor, which seamlessly transitions into a regular NPS Tier-I account once the child turns 18.

tax comply

May 223 min read

Taxation of Life Insurance Policies (Other than ULIP and Keyman Policies)

Introduction: Life insurance is often seen as a dual-purpose financial tool: it provides protection for your family and offers various...

tax comply

May 163 min read

NRI Taxation - Part 1 -Determination of Residential status of NRI

An NRI's income tax in India depends on their residential status for the year. If you are classified as a resident, your global income is...

tax comply

Jul 1, 20242 min read

Leave Travel Allowance - Exemption

Leave Travel Allowance (LTA) is a component of an employee's salary package that is meant to cover the cost of travel during their leave...

tax comply

Feb 21, 20233 min read

Different types of Income taxable in India ?

In India, income tax is levied on various types of income earned by individuals, businesses, and other entities. Here are some of the...

tax comply

Feb 19, 20232 min read

bottom of page